JAMB Financial Accounting Questions and Answers 2025/2026 Expo Runz

Financial Accounting JAMB Runs 2025, Financial Accounting JAMB CBT 2025 Expo Questions, Financial Accounting JAMB Runs 2025 ,English JAMB CBT 2025 Expo Questions ,JAMB 2025 English Questions and Answers| Free JAMB 2025 Expo /Runs, JAMB 2025 English Questions and Answers| Free JAMB 2025 Expo /Runs

jamb question and answer 2025 jamb question and answer on English jamb English question 2025 JAMB answers, jamb question and answer on English 2025 JAMB question 2025 ,jamb question and answer on English jamb past questions and answers on Financial Accounting

Are you a JAMBITE? Who Need JAMB Per Subjects Questions and Answers on English, JAMB 2025 Financial Accounting Questions and Answers| Free JAMB 2025 Expo /Runs,JAMB 2025 English Questions and Answers| Free JAMB 2025 Expo /Runs, JAMB 2025 English Questions and Answers| Free JAMB 2025 Expo /Runs Free Answers for JAMB English 2025 Questions And Answers /Expo /Runs ? 2025 JAMB UTME (JAMB) Expo /Questions And Answers For All 2025 Jamb Candidates.

WARNING: What you are reading here is not a scam or what so ever trick you might think, also this article is only for 2025 JAMB CBT Candidates that will love to write once and pass without resitting for it next year.

If you are looking for Per Subjects jamb questions and answers on all subjects such as Financial Accounting, Use of English, Financial Accounting ,Financial Accounting, Financial Accounting ,Agriculture ,Financial Accounting ,Economics , Geography, Irs ,Irk,Crs ,Crk, Literature in English, Government Financial Accounting ETC . here is the right place

JAMB Financial Accounting Questions and Answers 2025/2026 Expo Runz: Are you a JAMBITE? Are you preparing to write the JAMB 2025 Financial Accounting exam? Do you need JAMB Financial Accounting questions and answers? If so, then you’ve probably come across various websites offering “Free JAMB 2025 Expo/Runs” or “JAMB Financial Accounting Questions and Answers.”

JAMB Financial Accounting 2025 Questions and Answers 2025 verified solution. Here is legit JAMB maths expo questions and answers that will help you score high, and get good JAMB result.

However, it’s important to be cautious and avoid falling for scams. Many websites claim to provide JAMB questions and answers, but in reality, they are scams designed to extort money from unsuspecting candidates.

JAMB Financial Accounting Questions and Answers 2025/2026 Expo Runz

At Expocoded.com, we are committed to providing genuine and reliable assistance to JAMB candidates. We understand the importance of passing JAMB in one attempt and not having to resit the exam the following year.

Our JAMB Financial Accounting 2025 Package is designed to help you pass JAMB Financial Accounting with ease. We provide real and correct JAMB questions and answers in the exact format you will see in the exam hall. Our package is not a scam, and we only offer our services to JAMB CBT Candidates.

We deliver our JAMB Financial Accounting questions and answers via email or De System at least midnight before your exam. We are very sincere about our delivery time and ensure that we deliver on time. We do not offer SMS delivery because the content of the questions is more than what SMS can contain.

We urge you to be vigilant and ignore scammers who promise to send you JAMB questions and answers a week or seven to two days before your exam. JAMB Financial Accounting questions and answers 2025/2026 cannot be sent as text messages.

Our JAMB Financial Accounting questions and answers page is accessible via our website. You can view your JAMB CBT Financial Accounting questions and answers on our website if your email is not working.

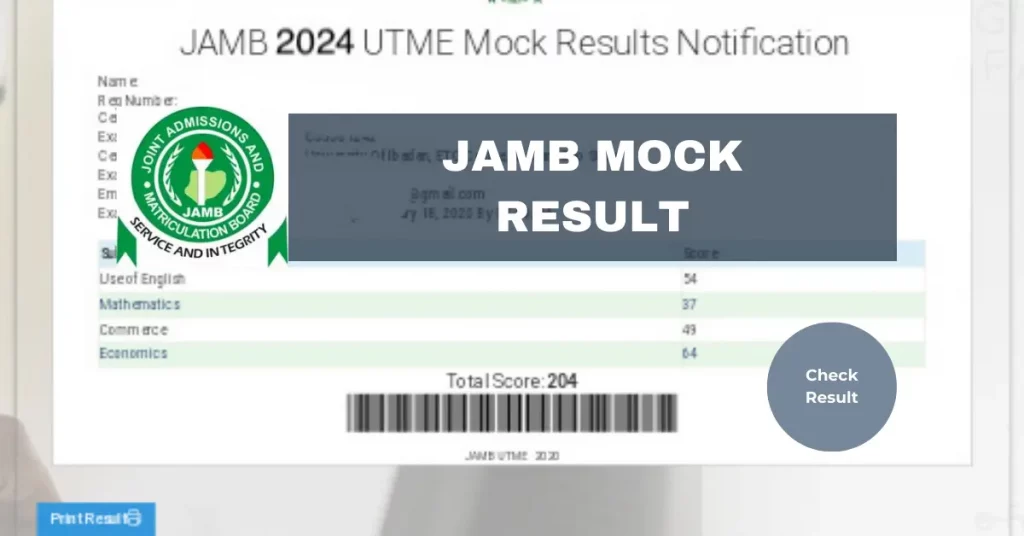

Our JAMB Runz Evidence

We have been helping students for several years to pass their exams, you can click here to see runz proofs

Subscription Price List for Financial Accounting JAMB CBT Exam 2025

| Method | Price |

|---|---|

| De System | 3000 |

| 3000 | |

| Answer Page | 3000 |

How to Subscribe

- Make choice of your desired package

- Message the admin on WhatsApp XXXXX

- Follow the instruction the admin will provide you.

2025 JAMB Runz, JAMB expo website, best JAMB expo site, free JAMB expo website, tomorrow JAMB expo, JAMB expo center

ALL AVAILABLE SUBJECTS:

- JAMB Questions and Answers 2025 Direct to System Uploading

- JAMB Questions and Answers 2025 for Use of English

- JAMB Questions and Answers 2025 for Mathematics

- JAMB Questions and Answers 2025 for Physics

- JAMB Questions and Answers 2025 for Chemistry

- JAMB Questions and Answers 2025 for Biology

- JAMB Questions and Answers 2025 for Agricultural Science

- JAMB Questions and Answers 2025 for Government

- JAMB Questions and Answers 2025 for Literature in English

- JAMB Questions and Answers 2025 for Commerce

- JAMB Questions and Answers 2025 for Economics

- JAMB Questions and Answers 2025 for Igbo

- JAMB Questions and Answers 2025 for Hausa

- JAMB Questions and Answers 2025 for Yoruba

- JAMB Questions and Answers 2025 for Christian Religious Studies

- JAMB Questions and Answers 2025 for Islamic Studies

- JAMB Questions and Answers 2025 for Computer Studies

- JAMB Questions and Answers 2025 for Principles of Accounts

- JAMB Questions and Answers 2025 for Physical and Health Education

- JAMB Questions and Answers 2025 for Music

- JAMB Questions and Answers 2025 for Home Economics

- JAMB Questions and Answers 2025 for Geography

- JAMB Questions and Answers 2025 for History

- JAMB Questions and Answers 2025 for Art

- JAMB Questions and Answers 2025 for Arabic

- JAMB Questions and Answers 2025 for French.

- Jamb Expo Whatsapp Group Link for 2025

- JAMB Recommended Textbooks for All Subject

- JAMB Syllabus for All Subject 2025

- How To Upgrade 2025 JAMB Cbt Results

0ur 2O25 JAMB Financial Accounting Questions and Answers are from certified legit sources, and with our special VIP treatment for early subscribers, you know that you have the best assistance in your JAMB CBT EXAM. We don’t just offer Jamb exam runs or a good Jamb expo site for 2025, we offer 280-320 JAMB SCORE. PLEASE DON’T FALL INTO ALL THESE NEW WEBSITES THAT DO NOT HAVE SOURCES, WE ARE OLD IN THIS BUSINESS, SUBSCRIBE WITH US FOR A BETTER RESULT IN YOUR JAMB 2025 (EXPO/RUNS)

We are the best 2025 JAMB cbt Expo website and legit jamb expo runz website in Nigeria. in other to know HOW TO GET ACCESS CODE we offer the best jamb runz and jamb 2025 expo, jamb cbt runs, jamb examination questions, and answers. Those who subscribed with us last year and other years’ exams can testify how we upload their jamb questions and answers directly to their computer because they registered in our database using our jamb 2025 access code.

Conclusion

Passing JAMB Financial Accounting 2025 is critical, and we are here to help you achieve that. Our JAMB Financial Accounting 2025 Package is designed to assist you in passing with ease. So, if you’re a female or male who lacks confidence, struggles with memorization or has written JAMB several times and hasn’t passed, we urge you to try our services. With our help, you can study the course of your dreams that requires a higher JAMB score.

Financial Accounting 2025 JAMB Questions and Runs 2025 Financial Accounting 2025 JAMB CBT 2025 Runs and Answers,Financial Accounting 2025 JAMB Questions and Runs 2025 ,Financial Accounting 2025 JAMB CBT 2025 Runs and Answers ,JAMB 2025 Financial Accounting 2025 Questions and Answers| Free JAMB 2025 Expo /Runs, JAMB 2025 Financial Accounting 2025 Questions and Answers| Free JAMB 2025 Expo /Runs

jamb question and answer 2025 jamb question and answer on Financial Accounting 2025 jamb Financial Accounting 2025 question 2025/2026 jamb answers, jamb question and answer on Financial Accounting 2025 2025/2026 jamb question 2025 ,jamb question and answer on Financial Accounting 2025 jamb past questions and answers on Financial Accounting

Are you a JAMBITE? Who Need JAMB Per Subjects Questions and Answers on Financial Accounting 2025, JAMB 2025 Financial Accounting Questions and Answers| Free JAMB 2025 Expo /Runs,JAMB 2025 Financial Accounting 2025 Questions and Answers| Free JAMB 2025 Expo /Runs, JAMB 2025 Financial Accounting 2025 Questions and Answers| Free JAMB 2025 Expo /Runs Free Answers for JAMB Financial Accounting 2025 2025/2026 Questions And Answers /Expo /Runs ? 2025 JAMB UTME (JAMB) Expo, /Questions And Answers For All 2025 Jamb Candidates. JAMB Financial Accounting Questions and Answers 2025, JAMB 2025 Financial Accounting expo, JAMB 2025 Financial Accounting runs, JAMB 2025 Financial Accounting runz